What Happens if I Continually Apply for a Credit Card

How does applying for a new credit card affect my credit score?

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit

this page.

Editor's note: This is a recurring post, regularly updated with new information.

The idea of earning free flights and hotel stays just by signing up for the right credit cards seems too good to be true, and there are plenty of myths about how it all works. When you're trying to introduce someone to the world of reward travel, you may have to dispel some of those misconceptions.

One of the most common things people believe when they start applying for new credit cards is that those actions will negatively and permanently impact their credit scores. While it is true that recklessly opening new lines of credit and abusing them (i.e. racking up large balances, carrying interest and missing payments) can hurt your credit score, there is no long-term impact on your score from simply opening new accounts.

Related: Yes, I have 22 credit cards; here's why

Since credit card sign-up bonuses are the foundation of travel rewards, today we'll take a look at how your credit score is affected when you open a new credit card.

New to The Points Guy? Want to learn more about credit card points and miles? Sign up for our daily newsletter.

Factors that affect your credit score

Even if you've done your research and decided which card you want to start with, you should not apply for it until you understand how your credit score is calculated.

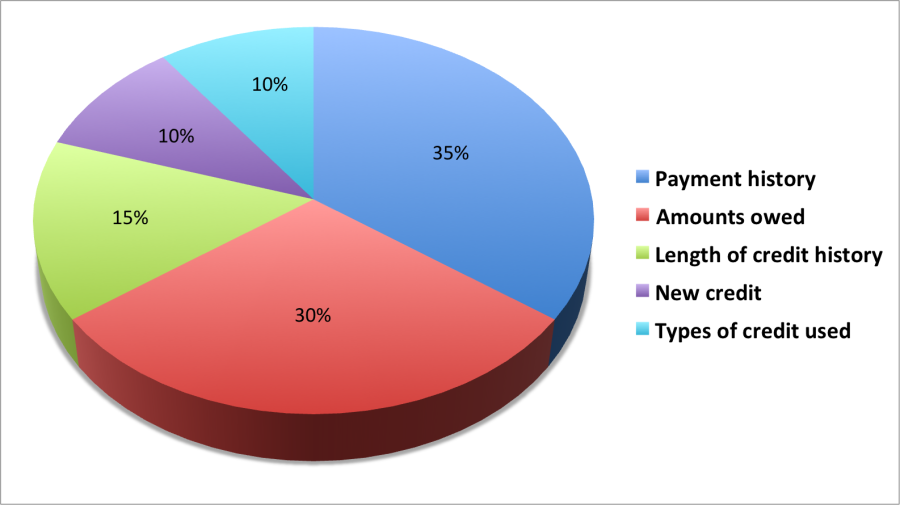

Here's a breakdown of the factors involved:

- Payment history (35%): It's no surprise that the category that carries the most weight is your on-time payment history.

- Amounts owed (30%): Also referred to as the utilization rate, this is the total balance on all your credit cards divided by your total credit limit.

- Length of credit history (15%): Also known as the average age of accounts, your credit history will result in a higher score the longer it is.

- Credit mix (10%): This refers to the various lines of credit you may have, including credit cards, student loans, a car loan and a mortgage.

- New credit (10%): New inquiries on your credit report account for 10% of your score.

Related: How credit scores work

Sign up for our daily newsletter

Hard inquiries vs. soft inquiries

Your credit is likely to be checked dozens of times over the course of your life, whether you're applying for a credit card or starting a new job. There are two different types of inquiries, and it's important to understand the difference.

Hard inquiries are times when your credit is checked in connection with an application for a new line of credit, such as a credit card or loan. These inquiries get reported to the credit bureaus and are the ones that appear on your credit report — and ultimately affect your score.

Related: What is the difference between a hard and soft pull on your credit report?

A soft inquiry would be if you checked your own credit report (to figure out if you were under 5/24 with Chase, for example) or let your employer check your credit as part of the hiring process. Soft inquiries do not get reported to the credit bureaus and won't impact your score in any way.

Related: Does Chase's 5/24 rule count inquiries?

How do hard inquiries affect your credit score?

Almost every time you apply for a credit card, you will receive a hard inquiry on your credit report. There are some exceptions, such as the fact that American Express often won't inquire about existing customers until the new application is approved. While the exact impact may vary from case to case, generally speaking, you can expect your score to drop by about five points each time you apply for a new credit card.

This might seem scary if you've been working to improve your credit score for a long time, but it's important to remember that the exact number is rarely what banks look at when evaluating your application. They'll put you into a range, say, 700-750 — so if your score drops from a 740 to 735, it is unlikely to have any real effect on future approval odds.

Related: What is a good credit score?

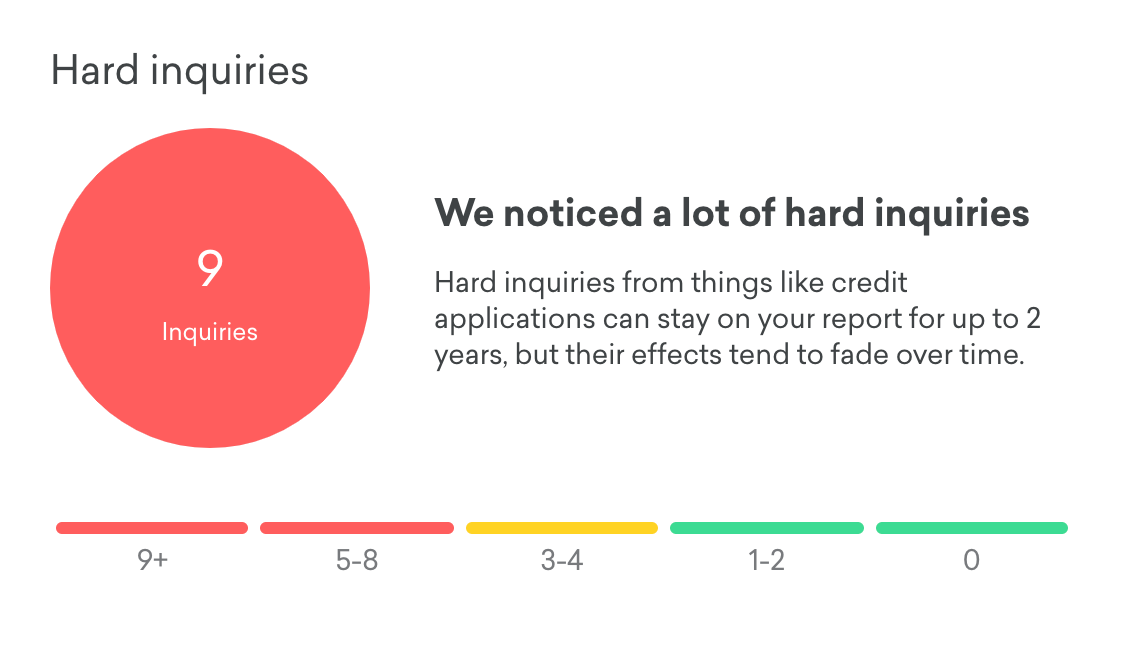

Having too many recent hard inquiries can drag down your score. Credit Karma says that your score starts to be impacted with three to four recent inquiries, but especially once you get above five. The inquiry will stay on your credit report for up to two years, but the impact fades over time. If you see a jump in your credit score one month that's not linked to any obvious event, such as paying off a balance, it may be the effect of your inquiries fading in relevance.

How many is too many?

A good credit score is something you can leverage to your advantage. If you put your score behind a glass display case and never tap your available credit, you're leaving valuable rewards on the table. I currently have nine inquiries on my TransUnion and Equifax reports, yet my scores are both excellent. This is mainly because I keep my utilization ratio low, pay every bill on time and never miss a payment.

Even though my nine hard inquiries place me in the red zone (according to Credit Karma), my overall credit health is great.

One area where you'll start to run into trouble is with card issuers that are "inquiry-sensitive." This is not an official policy, but certain banks — including Citi and Capital One — will often reject applicants with excellent credit scores because they have too many recent inquiries on their credit reports. As an example, I applied for the CitiBusiness® / AAdvantage® Platinum Select® Mastercard® to take advantage of a past sign-up bonus, and I was rejected partly because of the large number of recent inquiries on my credit report.

The information for the CitiBusiness AAdvantage Platinum card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Unfortunately, there's not much you can do about this other than be aware of the policies. If you're one of those people who likes to apply for credit cards in batches of two to three at a time, you should try and do your Citi and Capital One applications first to minimize the number of recent inquiries on your report.

Related: The ultimate guide to credit card application restrictions

Bottom line

A crucial step in becoming comfortable applying for credit cards is learning the factors that affect your credit score knowing that the impact on your score from an application is minimal. A five-point drop is a small price to pay if it helps you unlock a sign-up bonus worth $1,000 or more in free travel.

Remember that the drop is only temporary. Not only will the effect of the inquiry fade over the course of two years, but in the long term, you can also boost your score by continuing your history of on-time payments and increasing the average age of your credit accounts.

Additional reporting by Benét J. Wilson.

Featured image by

NurPhoto via Getty Images

Editorial disclaimer: Opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

TPG featured card

Highest Offer in 5 Years

Intro offer

80,000 bonus points

Recommended Credit

740-850

Excellent

Why We Chose It

If you are looking to take your premium rewards to the highest level, this card is really a no brainer in our eyes. Chase's Ultimate Rewards make points easy to redeem, with a wide range of 10 airline and three hotel transfer partners and a friendly user interface. Despite the high annual fee, Chase is consistently adding new benefits to keep the card competitive in a fierce premium rewards field.

Pros

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year

- Access to Chase Ultimate Rewards hotel and airline travel partners

- Unlimited 3x points on the broad category of travel and dining

- 50% more value when you redeem your points for travel through Chase Ultimate Rewards®

- Broad definitions for travel and dining bonus categories

Cons

- Steep $550 annual fee

- May not make sense for people that don't travel frequently

- You must spend the $300 travel credit before earning 3x points for travel and dining

- No automatic hotel elite status

- Earn 80,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,200 toward travel when you redeem through Chase Ultimate Rewards®

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Ultimate Rewards®. For example, 80,000 points are worth $1,200 toward travel

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

Highest Offer in 5 Years

Rewards Rate

| 10x | Earn 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards®. |

| 5x | Earn 5x total points on flights through Chase Ultimate Rewards®. |

| 3x | Earn 3x points on other travel and dining. |

| 1x | Earn 1 point per $1 spent on all other purchases |

-

Intro Offer

80,000 bonus points

-

Annual Fee

$550

-

Recommended Credit

740-850

Excellent

Why We Chose It

If you are looking to take your premium rewards to the highest level, this card is really a no brainer in our eyes. Chase's Ultimate Rewards make points easy to redeem, with a wide range of 10 airline and three hotel transfer partners and a friendly user interface. Despite the high annual fee, Chase is consistently adding new benefits to keep the card competitive in a fierce premium rewards field.

Pros

- $300 annual travel credit as reimbursement for travel purchases charged to your card each account anniversary year

- Access to Chase Ultimate Rewards hotel and airline travel partners

- Unlimited 3x points on the broad category of travel and dining

- 50% more value when you redeem your points for travel through Chase Ultimate Rewards®

- Broad definitions for travel and dining bonus categories

Cons

- Steep $550 annual fee

- May not make sense for people that don't travel frequently

- You must spend the $300 travel credit before earning 3x points for travel and dining

- No automatic hotel elite status

- Earn 80,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,200 toward travel when you redeem through Chase Ultimate Rewards®

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Ultimate Rewards® immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Ultimate Rewards®. For example, 80,000 points are worth $1,200 toward travel

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more

Source: https://thepointsguy.com/guide/how-does-applying-for-new-credit-card-affect-credit-score/

0 Response to "What Happens if I Continually Apply for a Credit Card"

Enviar um comentário